Why DIY Offering Memorandums Hurt Credibility in Commercial Real Estate

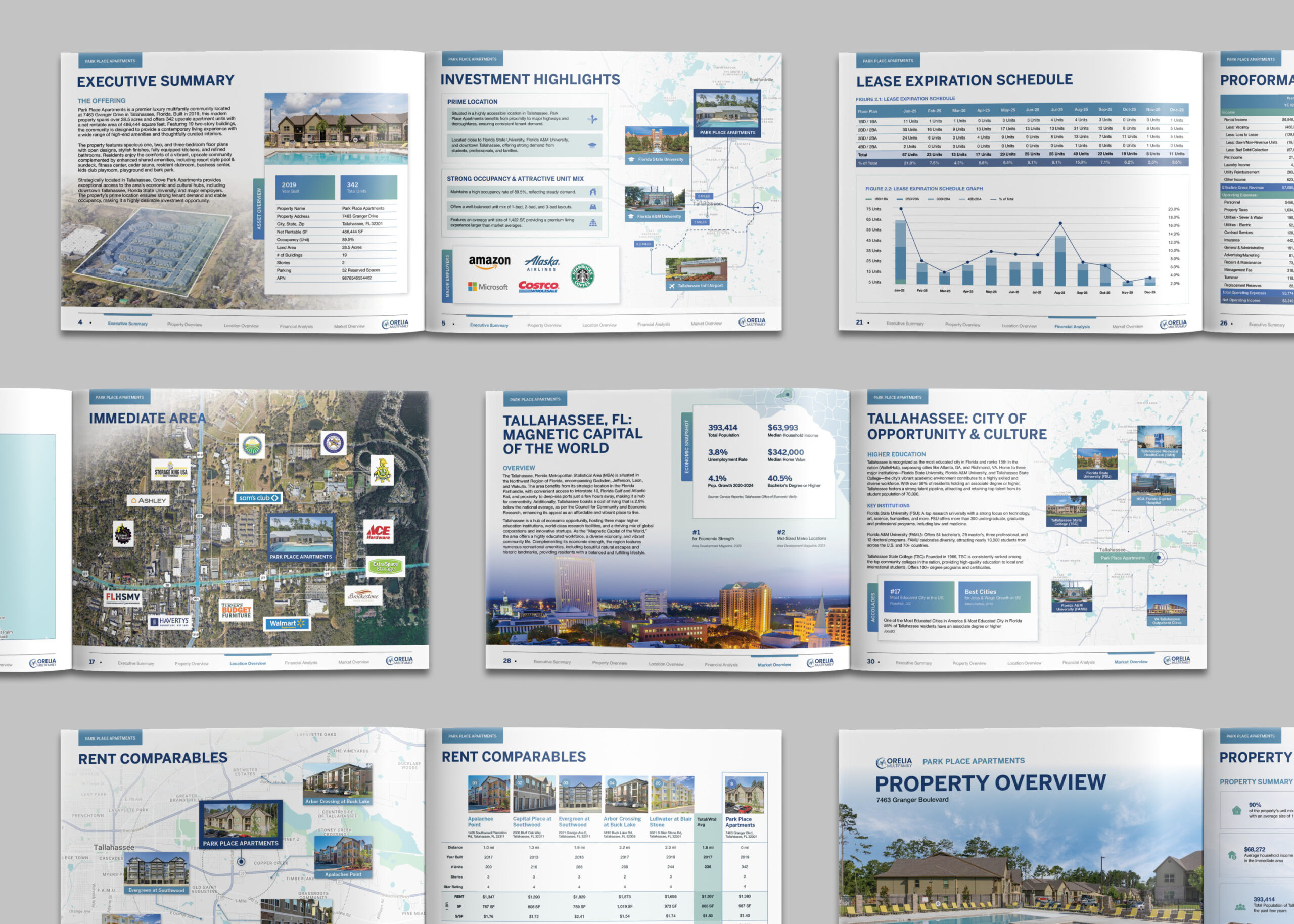

In commercial real estate, presentation isn’t just a bonus — it’s part of the deal.

And that glossy, info-packed Offering Memorandum (OM) you send out? That’s often the first impression you make with investors or buyers. It tells them who you are, how you operate, and whether you’re someone they want to do business with.

So here’s a real question worth asking:

If you’re still DIY-ing your OMs, is that helping or quietly hurting your credibility?

Let’s break it down.

1. You Never Get a Second Shot at a First Impression

In CRE, investors are scanning hundreds of deals. They can spot an amateur-looking OM in under five seconds, and sometimes, that’s all it takes to lose them.

According to a Behavior & Info Tech study, people form an impression in just 50 milliseconds.

That means:

- Sloppy formatting?

- Too much text jammed in one page?

- Generic charts copied from Excel?

They might not even get to your rent roll before closing the tab.

2. You Could Be Leaving Money (or Interest) on the Table

Let’s be honest, your OM isn’t just an info packet. It’s a sales tool. It should guide your reader through the logic of the deal: the story behind the asset, the strength of the tenant, the potential upside.

If your OM makes that hard to follow, if it’s vague, messy, or lacks visual structure, you’re not helping the deal sell itself. And in a market where investor attention spans are shrinking, that could mean missed opportunities.

3. You’re a Deal Maker, Not a Document Designer

Most CRE pros didn’t enter the industry to become part-time layout artists. And yet, here we are spending hours resizing aerial maps, formatting bullet points, or fixing alignment issues on PDFs.

A McKinsey report found that executives lose up to 20% of their week on tasks they could delegate.

If that’s you fiddling with font sizes at midnight, maybe it’s time to rethink where your time is best spent.

4. There’s Legal Risk in “Doing It Yourself”

Here’s something that’s often overlooked: compliance.

DIY OMs sometimes miss crucial disclaimers, disclosures, or context around projections. If your OM presents overly optimistic returns or lacks proper legal footnotes, it could create problems down the line.

Even if there’s no bad intent, these oversights can raise red flags, especially when you’re dealing with institutional investors or legal teams that read everything.

5. Professional OMs = Higher Trust, Faster Buy-In

At its core, an Offering Memorandum is about trust.

A polished, well-organized OM sends a clear message:

“I know my numbers. I’ve done my homework. I’m serious about this deal.”

In contrast, a DIY-looking OM might accidentally say:

“I rushed this. I’m winging it. Please don’t zoom in on page 7.”

You don’t want your materials raising doubts when your asset is actually strong

Final Takeaway

In this industry, you’re constantly being evaluated often before you even say a word. And in many cases, your Offering Memorandum is that first word.

If it looks like a placeholder, feels like a template, or reads like a chore, it might be holding you back more than you think.

So next time you hit “save as PDF” on a last-minute OM, ask yourself:

Is this the impression I want to make?

And if the honest answer is no, then maybe it’s time to stop doing it all yourself.

Outsourcing your OM design and prep isn’t just about saving time—it’s about showing up like a pro. You get to focus on the deal-making, while someone else handles the storytelling and polish. In a market where every detail matters, that can make all the difference.